THE ULTIMATE GUIDE Cryptocurrency Trading

Learn All About Trading Bitcoin and Cryptocurrency

Trading makes it possible to make money when the price varies. This is something that has become popular with cryptocurrencies. Bitcoin is the first and largest cryptocurrency, but there are hundreds of others on the market.

Some popular cryptocurrencies to trade are Ethereum, Ripple, and Litecoin. In this guide, we will explain all the benefits of cryptocurrency trading and how it works.

If we compare the stock market to the crypto market, there are many advantages with the trading cryptocurrencies. We will go through everything you need to know to get started with cryptocurrency trading.

Learn about technical analysis, trading strategies, trading software, market psychology, leverage trading, best trading platform and much more.

CHAPTER 1

Why Trade Cryptocurrencies?

CHAPTER 2

How to Start Trading Bitcoin

CHAPTER 3

Trade Bitcoin with Leverage

CHAPTER 4

Cryptocurrency Market Psychology

CHAPTER 5

Best Trading Exchange

CHAPTER 6

Trading Tips for Beginners

WINNER

Buy Cryptocurrency Here

FAQ

Frequently Asked Questions

Top 3 Trading Exchanges - July 2025

| # | Most PopularExchange | Rating | Services | Deposit / Withdraw | Fees / Spread | Why Open Account? | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|  | 98 | All-in-One | Low$0 / $5 | Low$0 / ~0.75% |

| |||||

| Payment Methods: | Cryptocurrencies: | Payment Methods: | |||||||||

|  | 87 | Exchange | Low | Mid |

| |||||

|  | 85 Read Review | Exchange | Low$0 / $2 | Mid1.49-3.99% + ~0.50% |

| |||||

| 4 |  | 85 | Exchange | Low | Mid |

| |||||

| 5 |  | 85 | Exchange | Low | Mid |

| |||||

| 6 |  | 85 | Exchange | Mid | Low |

| |||||

| 7 |  | 79 | Exchange | Low | Mid |

| |||||

| 8 |  | 77 | Exchange | Low | Mid |

| |||||

| 9 |  | 76 | Exchange | Low | Mid |

| |||||

| 10 |  | 75 | Exchange | Low | Low |

| |||||

| 11 |  | 75 | Exchange | Mid | Mid |

| |||||

| 12 |  | 70 | Exchange | Low | Mid |

| |||||

| 13 |  | 70 | Exchange | Mid | Low |

| |||||

| 14 |  | 70 | Exchange | Low | Mid |

| |||||

| 15 |  | 66 Read Review | Exchange | Mid | Low |

| |||||

| 16 |  | 65 | Seller | High$0-25 / 0.10-0.90% | High 3.90-8.99% + 2.00% |

| |||||

| 17 |  | 62 | Exchange | Mid | Mid |

| |||||

| 18 |  | 57 | Exchange | High | High |

| |||||

| 19 |  | 55 | Exchange | BTCDeposits only crypto | Low |

| |||||

Only Crypto: No Fiat Deposits (USD/EUR) | |||||||||||

Welcome to CryptoRunner! I’m David Andersson, co-founder of this site.

We understand that cryptocurrencies can be confusing and frustrating. That’s why we are here to help you.

Keep reading!

CHAPTER 1

Why Trade Cryptocurrencies?

As mentioned, there are many advantages of trading of Bitcoin and cryptocurrency. Above all, many things make it easier to trade cryptocurrency than other assets.

First and foremost, it is very easy to get started. You can open an account at a Bitcoin exchange and start trading right away.

Opening an account with a broker on the stock market can take a long time. Also, there are closing times, and the market is not opened during weekends.

The crypto market, on the other hand, is open 24/7 every day of the week. You have the freedom to trade Bitcoin and hundreds of cryptocurrencies whenever you want.

Another advantage of trading cryptocurrency is that it is both faster and cheaper to transfer money. Withdrawals and deposits are performed directly, and it costs almost nothing to move cryptocurrency to and from Bitcoin exchanges.

You don’t have to wait for the bank to open and approve your transfer. With cryptocurrency, no central authority can limit or deny your transaction.

Here we have listed some of the reasons why trading cryptocurrency is better:

- Lower fees and smaller spreads – Transaction fees are significantly lower than with conventional stockbrokers. Besides, the price difference between buying and selling is usually less, which reduces the risk. Keeping costs low is very important for traders.

- Absence of institutions and algo trading – Many institutions and major players in the financial market are still outside the crypto market. There is also less robot trading and manipulation of cryptocurrencies than ordinary currencies. This leads to a fairer and easier market for trading.

- More people with little market experience – Because there are many small savers within cryptocurrencies, technical analysis works better. Trends and patterns are much easier to analyze. Individuals without experience make many mistakes on the market.

Cryptocurrency Trading is faster, cheaper and easier than other options. Below we explain how to get started with trading Bitcoin and cryptocurrency.

CHAPTER 2

How to Start Trading Bitcoin

The success of Bitcoin has led to many other cryptocurrencies. Bitcoin is still the primary digital currency, which means that all cryptocurrencies are traded against Bitcoin.

Therefore, we recommend starting with Bitcoin if you want to get started with cryptocurrency trading. Before you start trading, you need a strong foundation to stand on.

You should be well-read about the cryptocurrency you want to trade. But above all, you need to understand technical analysis to analyze the price and chart patterns. We will go through what technical analysis is and how it works.

The first thing you need to start trading Bitcoin, Ethereum, Ripple and all other cryptocurrencies is a digital wallet.

We strongly recommend buying a hardware wallet and that you don’t store money in online wallets on exchanges. In this guide, you will learn everything about Bitcoin wallets and how to protect your cryptocurrencies.

When you have a safe and private wallet, it’s time to choose an exchange for trading. Different exchanges are good for different cryptocurrencies, but you should use multiple exchanges to spread the risk. For a better insight into cryptocurrency exchanges, read the guide on Bitcoin exchanges.

Trading Bitcoin and cryptocurrency requires patience. The most common mistake for beginners is that they do too many trades. Trading is a statistical game with probabilities. Don’t take unnecessary risks.

Bitcoin Price and Volatility

The price of Bitcoin will be what people are willing to pay. How the price changes will depend on many factors, but above all, future expectations.

If the market expects improvements and increased users of cryptocurrencies, the price is likely to increase. At the same time, there are external factors that affect the price.

There is a strong correlation between Bitcoin and other cryptocurrencies because they all are traded with Bitcoin. The price can develop in the same direction or opposite to each other. However, because cryptocurrencies are part of the same market, they usually trend together.

We can see that Bitcoin increases and decreases in price based on how other cryptocurrencies are traded. If a cryptocurrency is sold, the money will usually be transferred to Bitcoin, which can create a buying pressure.

The strong correlation of cryptocurrencies makes it necessary to monitor the price of Bitcoin no matter what cryptocurrency you’re trading. Although the long-term trend is common, prices may vary widely over shorter periods of time.

Volatility is usually higher in smaller cryptocurrencies, mainly due to increased risk. Another reason is that orders affect the price more because the market value is less.

This leads us to the order book which shows all active orders in the market. In trading exchanges, you will see a list of all orders. It shows volume at different price levels and is good to keep track of to see supply and demand of cryptocurrencies.

CHAPTER 3

Trade Bitcoin with Leverage

There are several exchanges that offer leverage trading. This is also called margin trading and means you borrow money for trading. Margin trading can be a good tool for traders.

You will realize that you can earn a lot more money by using leverage with cryptocurrency trading. At the same time, you can lose a lot more money. Margin trading increases the risk.

Let’s say you think the price of Bitcoin will go up. Therefore you open a long position with 1:2 leverage with $100 in your account. That means you buy BTC for $100 of your own money and borrow another $100.

There are also exchanges that offer margin lending. This means that anyone can lend money to traders on the platform. One exchange offering margin lending is Bitfinex.

The interest rate for margin trading varies depending on supply and demand. But because it’s an open market, interest rates tend to be low.

Margin trading is risky, especially if you use a big leverage. Bitcoin is very volatile, and the price can be changed hundreds of dollars in a few hours. In other words, your money can disappear quickly.

NOTE! We strongly recommend that you always use stop loss when trading Bitcoin and cryptocurrency with leverage.

Starting trading Bitcoin with leverage is easy. In most cases, you open a margin account at your exchange and can immediately start buying and selling cryptocurrency with leverage.

Many exchanges offer cryptocurrency trading with leverage. A popular trading exchange that offers margin trading is CEX.IO.

CHAPTER 4

Cryptocurrency Market Psychology

Most price movements are because of market psychology. This is evident when we see herd behavior and seasonal patterns which are not rational. People buy and sell cryptocurrency based on emotions. This is one reason why Bitcoin is volatile.

Because traders earn money on volatility, this is positive. By not trading with emotions, we can instead make money from overreactions in the crypto market. Even if investors have made a rational value, they can’t avoid psychological factors.

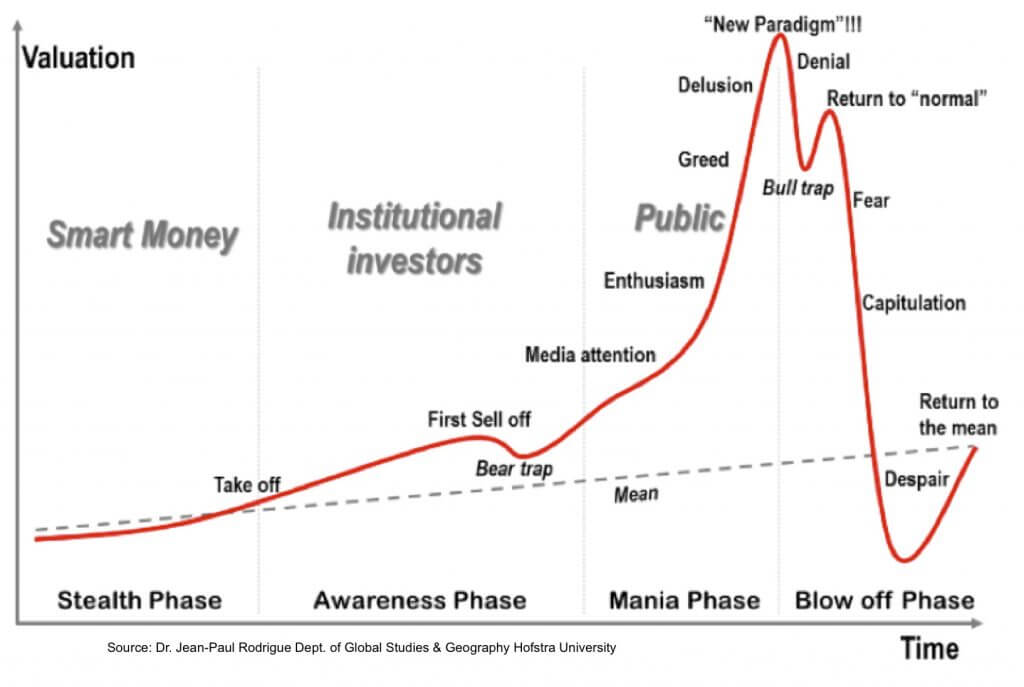

You need to eliminate all the feelings and have a clear trading plan. In many cases, it’s all about avoiding herd behavior that leads to bubbles in markets. Bubbles are created in all markets, and they create opportunities to make money.

If you look at the image, you see how a bubble is created in the market. Initially, smart money and investors buy the asset because it’s undervalued. Market psychology begins seriously when it’s mentioned in the media.

When all the media start writing about Bitcoin, the big mass notice the cryptocurrency. This increases the buying pressure, the price increase continues, and the market becomes euphoric but also greedy.

A problem with all-time highs is that there are no support or resistance levels. Technical analysis becomes more complicated because the price is in uncharted waters.

Sooner or later, when the price drops for some reason, you can expect powerful movements. The market takes the stairs up and the elevator down.

One old saying is “buy the rumor, sell the news“. When the news begins to talk about something, it’s a red flag on the market. Market psychology is a major part of trading that should not be underestimated.

Many traders have made the mistake of buying at the top and selling at the bottom. What separates a successful trader from someone who loses money is that the person learns from his mistakes.

“Be fearful when others are greedy and greedy when others are fearful” – Warren Buffett

CHAPTER 5

Best Trading Exchange

As a trader, you continuously need to adapt to the market. The same applies to exchanges in the crypto market. There are constantly opening up new trading exchanges, and you need to stay up to date.

With cryptocurrency trading, it’s important that there are high trading volume and high volatility. If an exchange has low volume, the spread increases, which means that the price difference between the buying and selling price increases.

If the exchange doesn’t have enough trading volume, it becomes more expensive to buy and sell cryptocurrencies. At the same time, it’s important to have good liquidity at the exchange to ensure there are a buyer and seller at all price levels.

You don’t have to worry about trading volume and liquidity if you use one of the larger cryptocurrency exchanges. Don’t spend too much time choosing the right exchange for trading.

There is no trading exchange that is superior to others. Different exchanges offer different cryptocurrencies. Trading platforms also have different chart tools and features.

Also, using one exchange for all your money is risky because the company can go bankrupt. Therefore, we strongly recommend that you use multiple exchanges and store your cryptocurrencies in a secure wallet.

We also recommend that you use two-factor authentication for additional security at the exchanges. Two popular exchanges for Bitcoin and cryptocurrency are CEX.IO and Bitfinex.

CHAPTER 6

Trading Tips for Beginners

We have several trading tips to help you get started. If you follow our tips and advice, you have good chances to make money with trading. As a trader, you need to continuously develop as the market is always changing.

You need to continue to learn new things and, above all, develop your skills in technical analysis. This is nothing that comes naturally, it takes time to learn trends and patterns in price charts.

Below we have compiled a starting kit for beginners in cryptocurrency trading. Including the most popular hardware wallet Ledger which secures your Bitcoin and other cryptocurrencies.

One of the most popular exchanges CEX.IO with a trading platform and very low fees. Last but not least, the best chart tool on the market, TradingView. It will help you with all technical analysis.

Here is a list of tips and advice to succeed in cryptocurrency trading:

- Learn about Bitcoin and blockchain technology – We recommend you to read our guides; What is Bitcoin? and How Does Bitcoin Work?

- Learn technical analysis and use candlesticks – You need to learn technical analysis and use candlestick charts because it contains much more information than line diagrams.

- Use a trading journal – Write down all your orders, check your statistics and evaluate your trading strategies.

- Learn from your mistakes – All traders make mistakes, but it’s better to make mistakes in the beginning when your capital is less. Learn from your mistakes, you paid for them.

- Ignore untrustworthy sources – Many fake news and cryptocurrency scams try to fool other people through “pump and dump”.

- Have achievable goals with a reasonable time horizon – Many who start trading have too high expectations.

- Protect profits and limit losses – A tip is to start with lock-in winnings and always use a stop loss. You need to be consistent as a trader.

- Learn the correlation between cryptocurrencies – There are clear correlations between Bitcoin and different cryptocurrencies. This can give you an advantage when trading cryptocurrency.

- Don’t risk too much in the beginning – Start slowly but surely and improve your trading every day.

| Buy Cryptocurrency Here

|

Risk Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Frequently Asked Questions

Is your question not answered here? Let us know!

A cryptocurrency is a decentralized digital currency. It’s called cryptocurrency because all transactions are protected by cryptography. However, the revolutionary with cryptocurrencies is the blockchain technology. This makes them completely decentralized. In other words, there is no bank, company or intermediary. By removing all middlemen you avoid expensive fees, long waiting times and the need to trust a third party. With cryptocurrency, you send money faster, cheaper and easier.

Yes! It is completely legal to use cryptocurrency such as Bitcoin. Individuals are allowed to use which currency they want as long as both parties agree on the same means of payment. However, there are countries that have indirectly or partially prohibited cryptocurrency. The reason for this varies, but generally, the government wants more control over the financial market. Here is a list of all countries’ laws about Bitcoin.

When you are not using your cryptocurrencies, you must keep them in a secure Bitcoin wallet. If you leave your Bitcoin at an exchange, mobile app or online, you risk losing all your money. The safest way to store Bitcoin is in a hardware wallet. Everyone needs at least one hardware wallet. Learn more in the guide: Best Bitcoin Wallet.

FORUM

Join The Discussion