If you’re looking for a beginner friendly crypto exchange with a lot of coins, copy trading tools and access to high leverage trades, BYDFi is probably already on your radar. This review about BYDFi walks you through everything that the exchange has to offer and how to open an account in only 5 minutes.

- 8,100 USDT bonus for new users

- +1,000 available cryptocurrencies

- Trading bots and copy trading tools

- Accessibility to high leverage up to 200x

- Customer support channels are limited

- Fees are less competitive to market leaders

- Many pairs have a minimum order size of around 10 USDT

Overview

CHAPTER 1

What is BYDFi?

CHAPTER 2

Open an account in 5 minutes

CHAPTER 3

BYDFi fees and costs

CHAPTER 4

Spot and perpetual trading

CHAPTER 5

Features and tools

FAQ

Frequently Asked Questions

PLATFORM

View Screenshots

CONCLUSION

Pros and Cons

CHAPTER 1

What is BYDFi?

BYDFi is a centralized crypto exchange founded in 2020, originally known as BitYard. The company’s slogan is “build your dream finance”. In simple terms, BYDFi wants to make trading feel less complicated and more accessible and easier to understand for both beginners and professionals.

You can think of it as an “all-in-one” app where you can buy and sell Bitcoin and Altcoins, trade futures with leverage, copy other traders and use trading bots. BYDFi focuses on being a “one-stop” platform for individuals interested in the crypto market.

How does BYDFi stand out?

If you so far only tried basic apps like Coinbase or Revolut, BYDFi will feel like a step up in terms of tools. Even if it comes with more tools and features, the platform is still more beginner-friendly than many “pro” exchanges. That is a big reason for its popularity.

Here are a few things that make BYDFi stand out:

- Hundreds of perpetual contracts with leverage.

- Access to built-in trading bots and copy trading tools.

- Offers both a website and a mobile app (Android and iOS).

- Protection Fund of 800 BTC adds an extra layer of safety for users.

- Has a growing global user base and a partnership with Newcastle United.

- Strategic partnership with hardware wallet leader Ledger, promoting easy and secure self-custody of assets.

CHAPTER 2

Open an account in 5 minutes

How to register account on BYDFi (app):

In this section, we guide you through how to open a BYDFi account. We will also walk you through how to place your first trade on the platform. The registration process only takes around 5 minutes to finish.

1. Create your account

Start by visiting BYDFi’s website. Use this link to get there and click on “Sign Up” to begin.

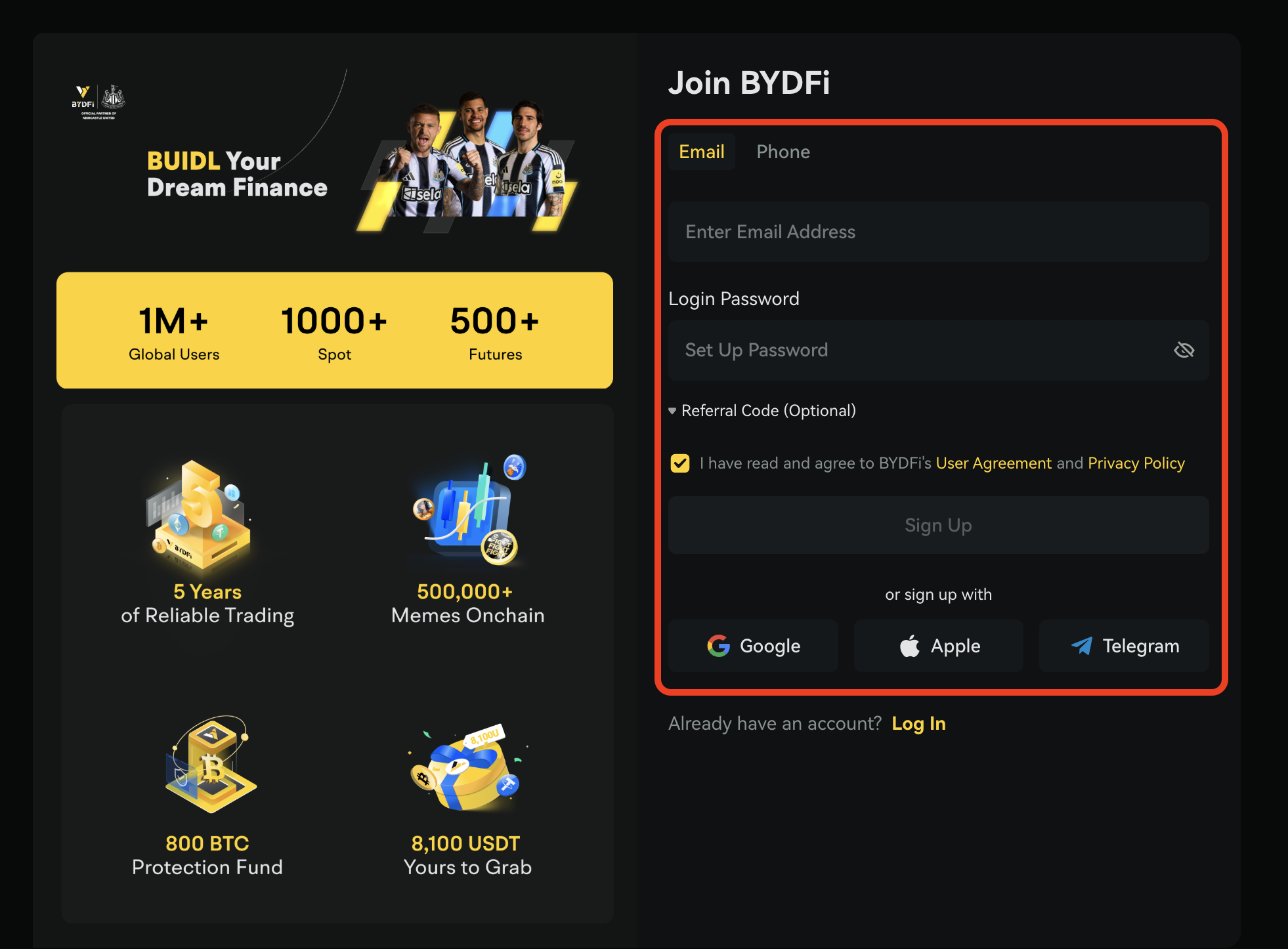

2. Sign up with email

Enter your email address, and create a password and then click “Sign Up”. You will be sent a verification code through email that you will be asked to enter to proceed with the registration.

3. Make a deposit

After the registration process is done, you are ready to make your first deposit. Click on “Quick Deposit” to fund your account.

4. Select which crypto to deposit

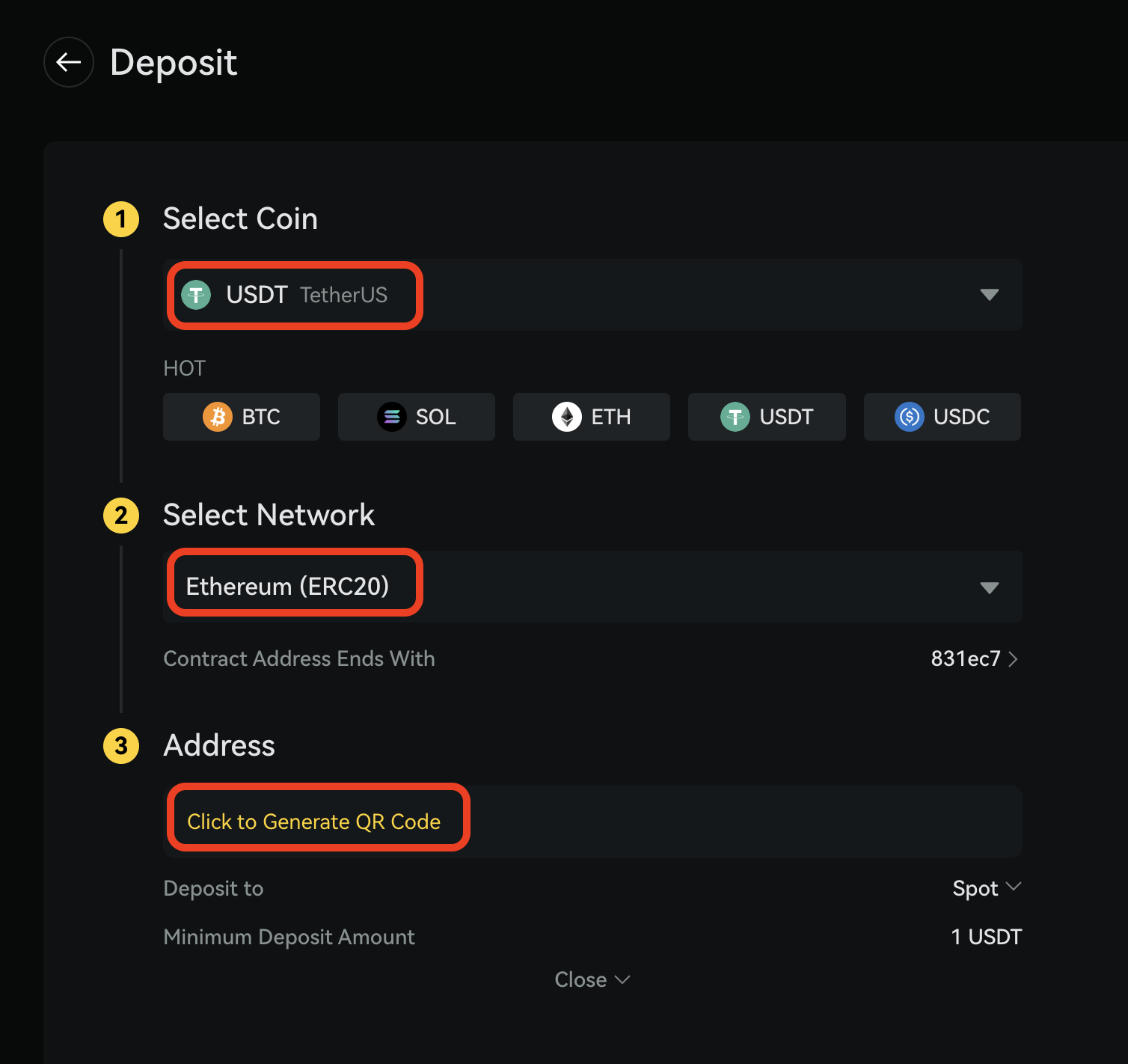

- Choose your desired crypto. In this example we will choose USDT, which is a stablecoin pegged to the US dollar.

- Choose through which network you wish to send the crypto to your account. Make sure that the network is supported both by BYDFi and your external wallet. For this example, we choose the Ethereum network.

- Next step is to click “Click to Generate QR Code” to show your public crypto address. Copy the address from BYDFi and paste it into your external wallet or other exchanges. Input the tag if required. Without the tag, the transfer might fail.

5. Start trading

After you have deposited crypto into your account, you can start trading. On the home page, click on “Start Trading” to begin.

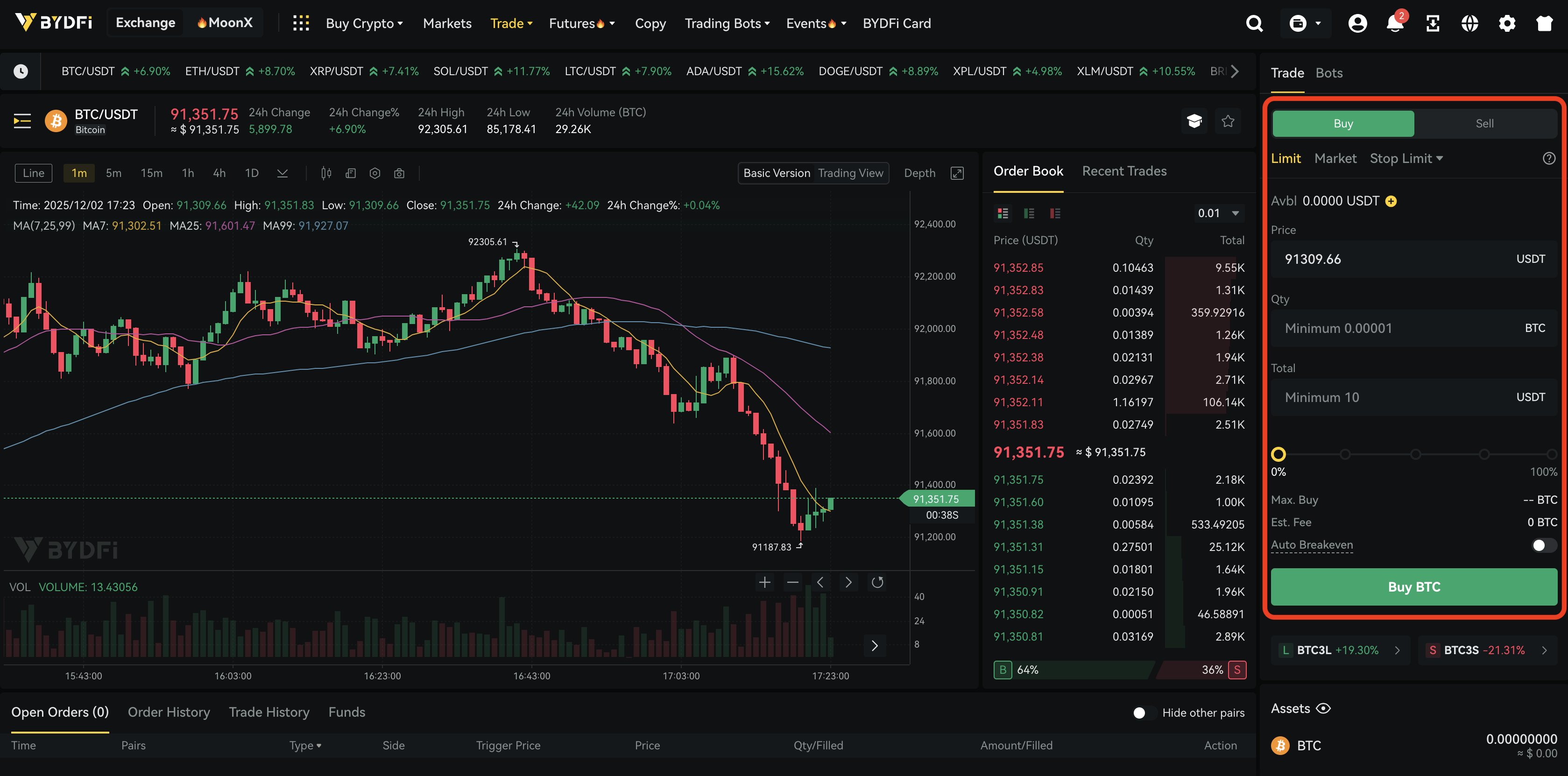

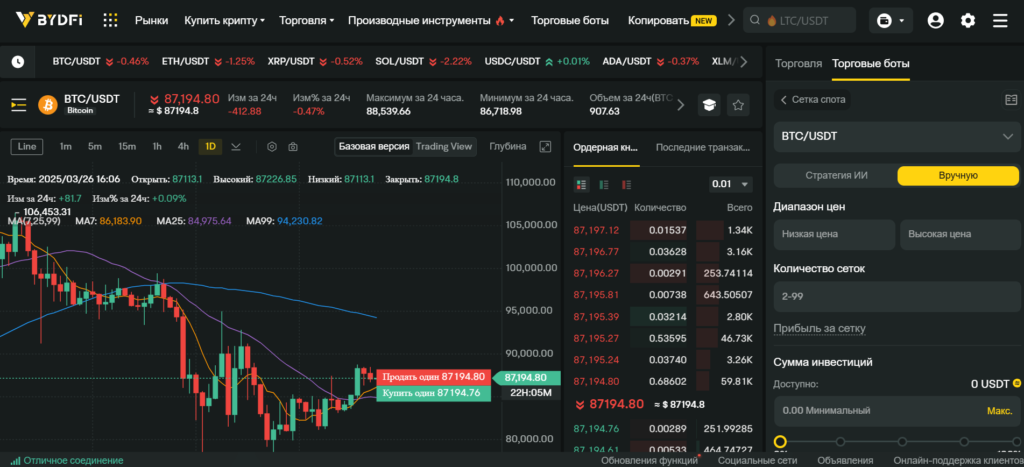

The chart below shows the current Bitcoin price. On the right-hand side, you can choose to go long or short by clicking “Buy” or “Sell”. For this example, we choose to go long.

Enter the price level where you want to place your order and select how much Bitcoin you want to buy. Then choose the total amount of money you want to invest and click “Buy BTC” to place your order.

That’s it, well done!

CHAPTER 3

BYDFi fees and costs

One of the most important aspects to BYDFi is their fees. In the table below is a breakdown of all the different fees and the typical range where they sit. Further down you can read a more detailed description about each of the different fees.

BYDFi fees:

| Type of fee | Amount | Information | Read more in… |

|---|---|---|---|

| Commission | 0.02–0.20% | Trading fees for buying different cryptocurrencies. | 3.1 |

| Deposit fee | Network fee* | Fee for depositing fiat or crypto into your BYDFi account. | 3.2 |

| Withdrawal fee | Network fee* | Fee for withdrawing your fiat and crypto to an external account or wallet. | 3.2 |

| Inactivity fee | Doesn’t exist | Fee for not being active during a specific time period. | 3.3 |

*Not charged by BYDFi, if not the blockchain itself.

(Table updated 2025)

3.1

Commission

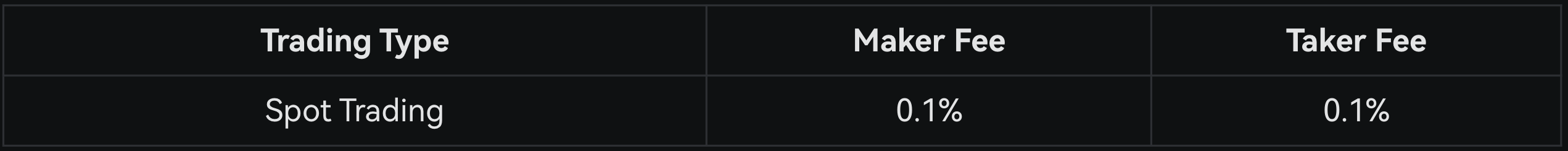

Spot crypto

(Source: BYDFi)

Each time you buy or sell on the BYDFi exchange, they take a small cut of your trade. The fee is also called “trading fee” or “commission”. On spot markets, this fee is usually quite low compared to many big other exchanges. It normally amounts to 0.10%.

Example: Imagine that the current price of Bitcoin is 50,000 USDT. Trader A uses 10,000 USDT to buy 0.2 BTC via a market order, while Trader B sells 0.2 BTC using a limit order. Trader A will pay a fee of 0.0002 BTC (0.20 x 0.1%), while Trader B will have to pay 10 USDT ((50 000 x 0.20 BTC *) 0.10%).

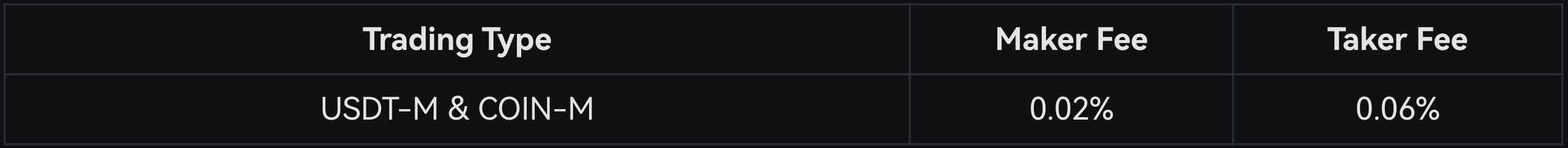

Futures trade

(Source: BYDFi)

Futures trading also has its own fee, but again, it’s in the same low range. The fee ranges between 0.02% and 0.06%, depending on which cryptocurrency pair you trade. When it comes to trading leveraged tokens, the fee typically equals around 0.20%.

3.2

Deposits and Withdrawals

Depositing and withdrawing funds on BYDFi is straightforward. For crypto deposits, BYDFi does not charge any deposit fees. You only pay the network fee from the wallet or exchange that you send from. The same rules go for withdrawing crypto from BYDFi.

The fee goes directly to the miners or validators of the specific network, not to BYDFi. How large the network fee depends on which network you use and the trading volume on the blockchain.

- The higher the trading volume, the higher the fee.

- The lower the trading volume, the lower the fee.

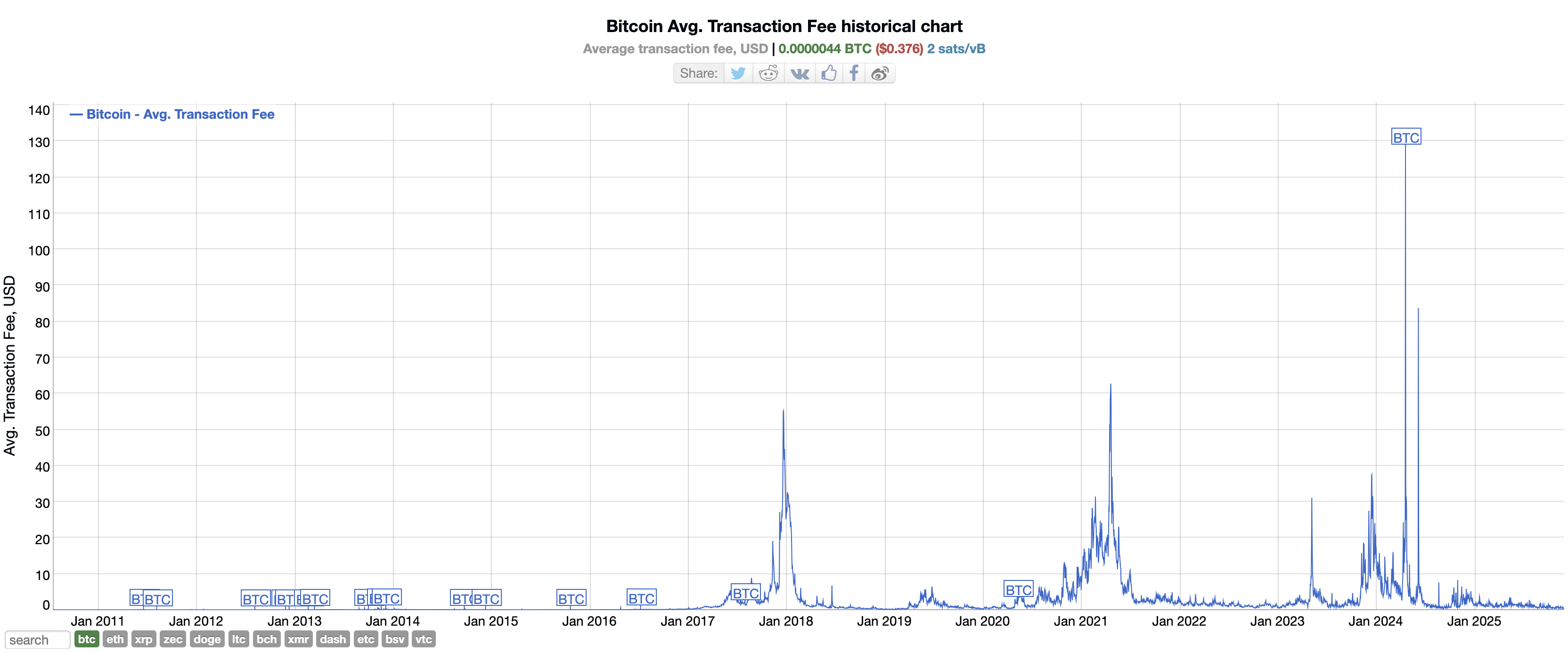

The chart below shows the average network fee on the Bitcoin blockchain. As we can see, the fee was especially high during the bull markets, such as 2017/2018, 2020/2021 and 2024. This is normal when prices start to rise quickly. During the last bull run, the fee reached as high as 130 USD per transaction (see image below).

BTC historical network fee:

(Source: bitinfocharts.com)

Tip! For a deeper dive, check out our complete guide to Bitcoin.

3.3

Inactivity fees

Some trading platforms charge an inactivity fee if you do not log in or trade for a certain period. BYDFi does not charge any inactivity fees. This means you can open an account, make a few trades, and then take a break without worrying about hidden charges eating into your balance.

CHAPTER 4

Spot and perpetual trading

BYDFi in-depth guide on perpetual contract trading:

BYDFi focuses strongly on both spot trading and perpetual contracts, which makes the platform interesting for different types of traders. Beginners can stay with simple spot trades, while more advanced users can access high leverage with perpetuals.

4.1

Spot trading

Spot trading is the easiest way to get started with BYDFi. When you trade on the spot market, you buy and sell real cryptocurrencies that are added directly to your account balance. For example, if you buy BTC/USDT on the BYDFi exchange, you receive actual BTC that you can hold, trade later, or withdraw to an external wallet.

BYDFi offers more than 1,000 spot trading pairs, which means you can access everything from large coins like Bitcoin and Ethereum to smaller altcoins. Spot trading is often the best choice for new users because it is more straightforward and less risky than leveraged trading.

(Source: BYDFi)

4.2

Perpetual trading

Perpetual contracts are BYDFi’s version of futures trading. Instead of buying the actual coin, you trade a contract that follows the price of the underlying cryptocurrency. One of the big advantages is that BYDFi offers more than 500 perpetual pairs, with the possibility of high leverage up to 200x on selected markets.

The purpose of using high leverage is to control a large position with a smaller amount of capital. However, it also increases the risk. A relatively small price movement against you can quickly result in a full loss of your margin and an automatic liquidation of your position.

Because of this, perpetual contracts are better suited for experienced traders who fully understand the risks and have a clear trading plan. If you are new to derivatives, start with very low leverage. You can also practise first with the demo account so that you don’t risk your hard-earned money.

CHAPTER 5

Features and tools

Besides classic spot and futures trading, BYDFi provides many unique tools that make the exchange stand out. In the following chapter, you can read about some of the most used tools and features on the platform.

5.1

Copy Trading

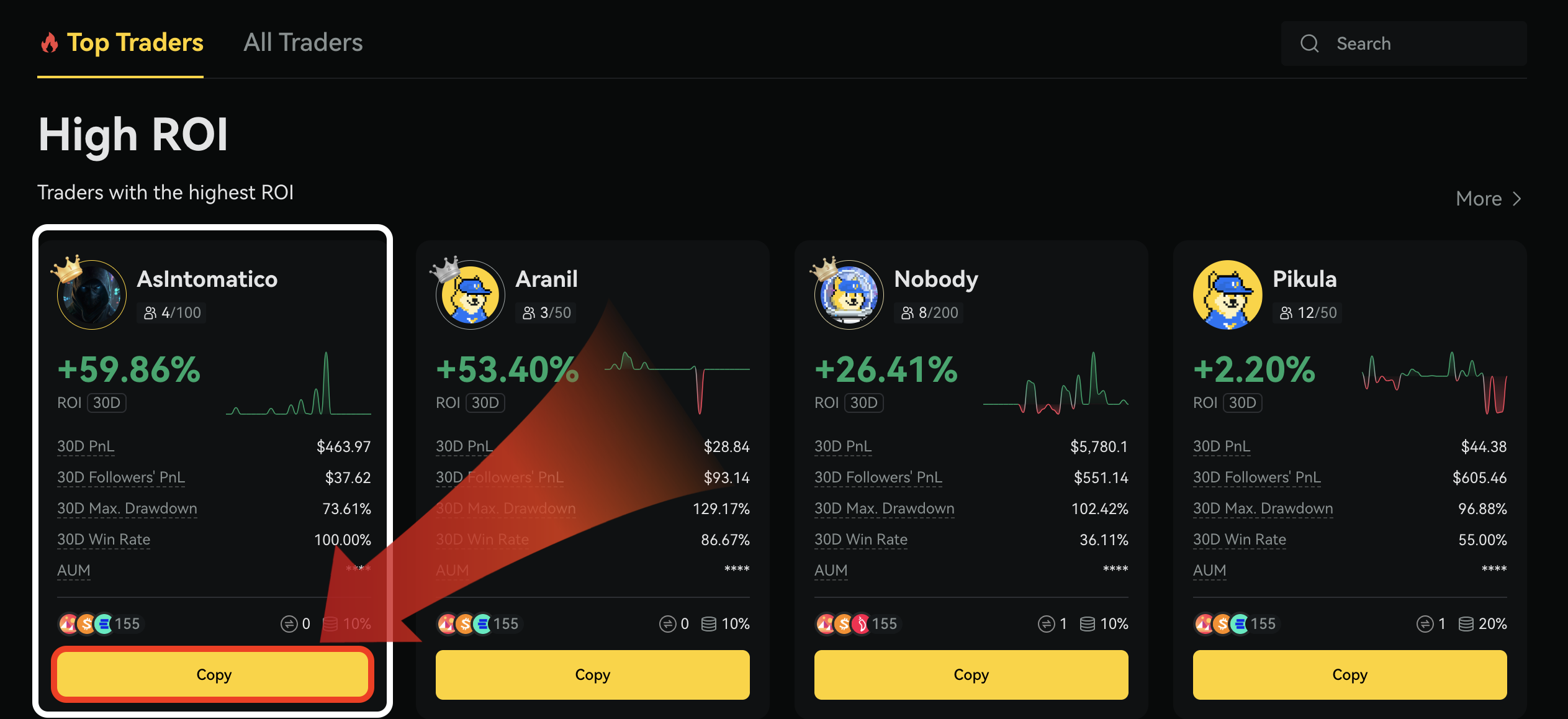

Copy trading is one of BYDFi’s main features. Instead of making all trading decisions yourself, you can choose a professional trader on the platform and automatically copy their trades in real time. You decide how much money you want to allocate and can stop copying at any time.

Example: Below is shown some of the top traders during a specific time at the end of 2025. As you can see, “AsIntomatico” has made a total return on investment (ROI) of almost 60% over the past 30 days. By clicking “Copy” you will automatically copy this person’s trading in real time.

(Source: BYDFi)

The main advantage of copy trading at BYDFi is the low minimum amount. You can start with as little as 10 USD. This makes the feature available even for the trader with very little capital.

BYDFi also supports copy trading in multiple assets, including popular coins like BTC, ETH and different memecoins. All fees and profits are shown transparently, so you always know how much you pay and how your copied trader is performing.

5.2

Spot Martingale

How to Trade Spot Martingale on BYDFi (app):

A unique feature on the BYDFi platform is the “Spot Martingale” strategy. It is designed for traders who believe in a long-term recovery of a coin but expect short-term price drops. The bot increases the purchase size each time the price falls, which lowers your average entry price. When the market eventually bounces, even a relatively small price recovery can bring the overall position back into profit.

Spot Martingale is similar to the DCA strategy (dollar cost average). It works especially well in volatile markets but requires enough capital to handle several rounds of purchase.

5.3

Trading Bots

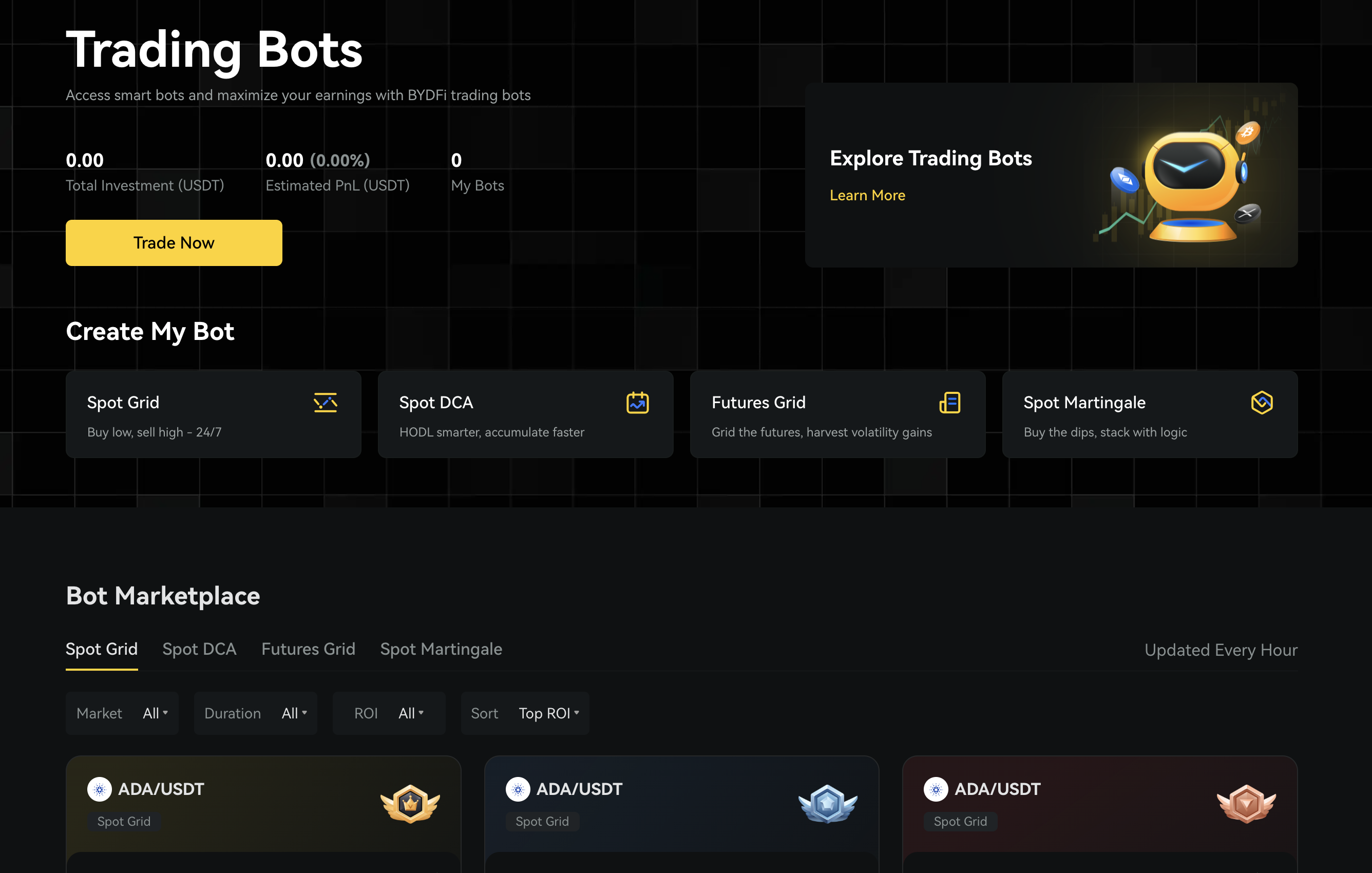

Another automated trading tool available on the platform is trading bots. BYDFi offers several types of trading bots with different trading and allocation strategies.

Common bot types

- Spot investment – Bots that help you accumulate coins by buying at regular intervals or within a price range.

- Spot grid bots – Bots that automatically buy low and sell high inside a chosen price corridor. This can be useful in sideways markets where the price moves up and down.

- Futures grid bots – Bots that apply the same logic to perpetual contracts, but with leverage. These bots can be powerful but also risky, so they should only be used by traders who understand how futures and margin work.

(Source: BYDFi)

The idea behind trading bots is to remove emotional decisions and follow a clear strategy. However, there is no guarantee of profit. You should always monitor your bots and adjust or stop them if market conditions change drastically.

Frequently Asked Questions

Is your question not answered here? Let us know!

Yes, BYDFi is a well-known crypto exchange that’s been around since 2020.

BYDFi is mainly used to buy, sell, and trade cryptocurrencies. You can trade spot, futures with leverage, use copy trading, trading bots and even access on-chain tokens via MoonX.

Yes, at BYDFi your cryptocurrencies are saved in cold storage, which makes it more secure than most exchanges. You can also enable Two-Factor Authentication (2FA) to your account, which makes it even safer.

BYDFi holds certain registrations in the US, which allows many American users to sign up. However, that doesn’t mean every product is allowed in every state, especially regarding high-leverage futures.

BYDFi was originally founded in Singapore where their headquarters is still located to this date.

Screenshots

Pros and Cons

- 8,100 USDT bonus for new users

- +1,000 available cryptocurrencies

- Trading bots and copy trading tools

- Accessibility to high leverage up to 200x

- Customer support channels are limited

- Fees are less competitive to market leaders

- Many pairs have a minimum order size of around 10 USDT

FORUM

Join The Discussion