THE ULTIMATE GUIDE Best Bitcoin & Cryptocurrency Broker

Looking for the best Bitcoin broker? There is a wide range of brokers on the crypto market, which doesn’t make the decision easier. If you want to trade Bitcoin (BTC) and cryptocurrency you need a broker with low fees, high leverage, and the best trading tools! Why should it be difficult?

We help you compare and choose the best Bitcoin trading platform. It only takes a few minutes to open an account. Learn everything about Bitcoin Trading and how to trade Bitcoin. This guide gives you the best chance to make money day trading Bitcoin. Get started now!

Below is our comparison table where you choose the best Bitcoin / Cryptocurrency Broker for you. In the beginner’s guide, we also help you choose the right Bitcoin trading software, trading tools, and successful Bitcoin trading strategies.

- Compare Trading Platforms

- Open Account

- Start Trading Instantly

CHAPTER 1

How to Choose the Right Cryptocurrency Broker?

CHAPTER 2

Basics 101: How to Trade Bitcoin

CHAPTER 3

Day Trading Bitcoin: Learn Technical Analysis!

CHAPTER 4

The Best Bitcoin Trading Software & Tools

CHAPTER 5

Get Started: Trading Bitcoins for Beginners

CHAPTER 6

Conclusion: Best Bitcoin Trading Platform

WINNER

Invest in Bitcoin here

FAQ

Frequently Asked Questions

FORUM

Join The Discussion

Top 3+ Bitcoin & Crypto Brokers - April 2024

| # | Most PopularExchange | Rating | Services | Deposit / Withdraw | Fees / Spread | Why Open Account? | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|  | 98 | All-in-One | Low$0 / $5 | Low$0 / ~0.75% |

| |||||

| Payment Methods: | Cryptocurrencies: | Payment Methods: | |||||||||

|  | 80 Read Review | Exchange | Low$0 / $2 | Mid1.49-3.99% + ~0.50% |

| |||||

|  | 80 | Exchange | Low | Mid |

| |||||

| 4 |  | 78 | Exchange | Mid | Low |

| |||||

| 5 |  | 75 | Exchange | Low | Mid |

| |||||

| 6 |  | 70 | Exchange | Low | Mid |

| |||||

| 7 |  | 70 | Exchange | Low | Mid |

| |||||

| 8 |  | 70 | Exchange | Mid | Low |

| |||||

| 9 |  | 66 Read Review | Exchange | Mid | Low |

| |||||

| 10 |  | 65 | Seller | High$0-25 / 0.10-0.90% | High 3.90-8.99% + 2.00% |

| |||||

| 11 |  | 62 | Exchange | Mid | Mid |

| |||||

| 12 |  | 60 | Exchange | BTCDeposits only crypto | Low |

| |||||

| 13 |  | 57 | Exchange | High | High |

| |||||

| 14 |  | 57 | CFD | Low | Mid |

| |||||

| 15 |  | 55 | Exchange | BTCDeposits only crypto | Low |

| |||||

Only Crypto: No Fiat Deposits (USD/EUR) | |||||||||||

Welcome to CryptoRunner! I’m David Andersson, co-founder of this site.

We understand that cryptocurrencies can be confusing and frustrating. That’s why we are here to help you.

Keep reading!

CHAPTER 1

How to Choose the Right Cryptocurrency Broker?

There are many things to compare when choosing the right Bitcoin and Cryptocurrency Broker. We have compiled the most important together with our rating in the comparison table above. This makes it easy for you to choose the Best Bitcoin Trading Platform.

However, there are more things that are good to check and compare. To choose the right broker, look at the following:

- Customer Satisfaction: The best way to choose bitcoin brokers is to test their trading platforms. But the quickest and easiest way is to listen to what their customers say. Are their customers satisfied? To help you answer that question, all brokers on this page have a rating (with numbers 1-100 and stars 1-5).

- Broker Regulation: It’s essential that you use a regulated broker. This is especially true when you’re trading cryptocurrencies. If the broker is unregulated, your money will not be protected. ** All brokers in our comparison table offers regulated CFD trading which means that your money is protected. **

- Fees and Costs: If you’re planning to trade Bitcoin and cryptocurrency you need to choose a broker with low fees and costs. NOTE! It’s common for brokers to advertise their platform with “zero fees”. However, this usually means you have to pay an additional cost called spread (the difference between buying and selling price).

- Trading Platform: The most important thing for a professional Bitcoin Trader is to use a good trading platform. (Provided that the broker is regulated and has reasonable fees.) The market consists of a variety of trading platforms with different features. You need to open an account and try!

- Minimum Deposit: Some brokers require a minimum deposit, while others don’t have any at all. If the minimum deposit is high, it usually means that the broker is serious. However, a trading account without any minimum deposit can be a way for new cryptocurrency brokers to get customers. For whatever reason, the minimum deposit should not affect your choice of broker.

- Customer Service: Not all cryptocurrency brokers offers reliable and fast customer support. Do they provide customer support 24/7? Is there chat support, phone support or both? Bigger players on the market usually offer this, but not always by smaller brokers.

- Leverage: You can always trade with leverage if you use Bitcoin CFDs. We recommend choosing a CFD broker because leverage is an important tool for traders. Leverage means that you can borrow money to get higher returns on your trades, but can also get losses in the same size. It usually varies between 1:5 and 1:30. NOTE! A typical beginner’s mistake is to use too high leverage. Use the tool responsibly!

- Free demo account: Cryptocurrency brokers usually, unlike exchanges, offers a free demo account. Take advantage of the opportunity to test the trading platform and its features. Or are you ready for the real deal? Deposit a smaller amount of money and make some buy and sell orders before you risk your capital. A good way to learn how to trade Bitcoin.

1.1

Beginner Guide: Best Bitcoin Trading Brokers

Are you a beginner or want to learn more about trading? You have come to the right place! This complete beginner’s guide will help you choose the best bitcoin trading broker and get started with trading. Making money on trading is harder than it seems. However, it’s easier to trade cryptocurrencies than other securities such as stocks. This is due to several reasons.

Advantages of Trading Bitcoin

- Lower fees and smaller spreads – Brokers with Bitcoin trading sites tend to have low fees and small spreads. This is because the crypto market is more transparent and easily accessible than other markets.

- Less price manipulation and algorithm trading – The stock market often gets criticism that larger companies and other groups manipulate the price. The majority of all orders are also executed by robots. Bitcoin and cryptocurrency is a smaller market with less price manipulation and algorithm trading. This creates a level playing field for all traders.

- More active individuals with little experience – Technical analysis, which is the foundation of successful trading, works better when the market consists of inexperienced individuals. Trends and patterns become more apparent and easier to analyze. All beginners in day trading make classic mistakes. You can take advantages of it.

What Is the Difference Between a Broker and Exchange?

If you want to earn money from trading cryptocurrency, we recommend a CFD Broker on this page. CFD (Contract For Difference) is a contract that reflects the price of an underlying asset. This includes cryptocurrencies. Brokers offer the best Bitcoin trading platforms because their products aimed at traders. Your money is also protected by the broker.

If you want to invest in Bitcoin and other cryptocurrencies, you can buy them at a Bitcoin Exchange. This is for long-term investors. But it also means you are in charge of security. NOTE! If you buy real cryptocurrency, you must also buy a Bitcoin Wallet to keep them safe.

Keep reading and learn how to trade Bitcoin →

CHAPTER 2

Basics 101: How to Trade Bitcoin

Do you have no experience of trading? Don’t worry! We will tell you everything you need to know about Bitcoin Trading. Learn the basics and start trading today →

What Is Trading?

Trading makes it possible to make (or lose) money when the price varies. This is something that has become popular with cryptocurrencies. Bitcoin is the first and largest cryptocurrency, but there are hundreds of others on the market.

Day trading Bitcoin, as the name suggests, means that you only trade during the day. In other words, all open positions are closed when the market closes. However, since the crypto market is open 24/7, you can trade Bitcoin around the clock!

How Does It Work?

There are two different ways to profit with trading. Either you earn money by buying low and selling high (this is called a long position). The price difference will be your profit.

You can also profit when the price drops by selling high and buying low (this is called a short position). When you take a short position, you sell cryptocurrency that you bought for borrowed money. If the price drops, you can buy it back lower and make the price difference.

You profit on the price difference when you trade cryptocurrency. This means that Bitcoin traders want to see significant price variations, also called volatility.

If there is high volatility, there are strong price movements. Therefore volatility is used as a risk measure. High volatility means big price variations but at the same time a big opportunity to profit with Bitcoin Trading.

This is the difference between trading and investing. If you invest in a cryptocurrency, you want the price to increase, but at the same time have low volatility.

As a trader, you earn money on volatility and high risk. Trading is a risky business which doesn’t fit everyone. It’s important to understand the risks of trading.

CHAPTER 3

Day Trading Bitcoin: Learn Technical Analysis!

There are two different methods for analyzing an asset, Fundamental Analysis (FA) and Technical Analysis (TA). Fundamental analysis is to evaluate the asset’s underlying value. For example, company reports are used to determine the fair value of a business.

With technical analysis, you let the market evaluate the financial asset and instead analyze price and volume to predict price movements. Technical analysis is based on statistics, and you use different parameters to see which price change is most likely.

Trends, Patterns, and Formations

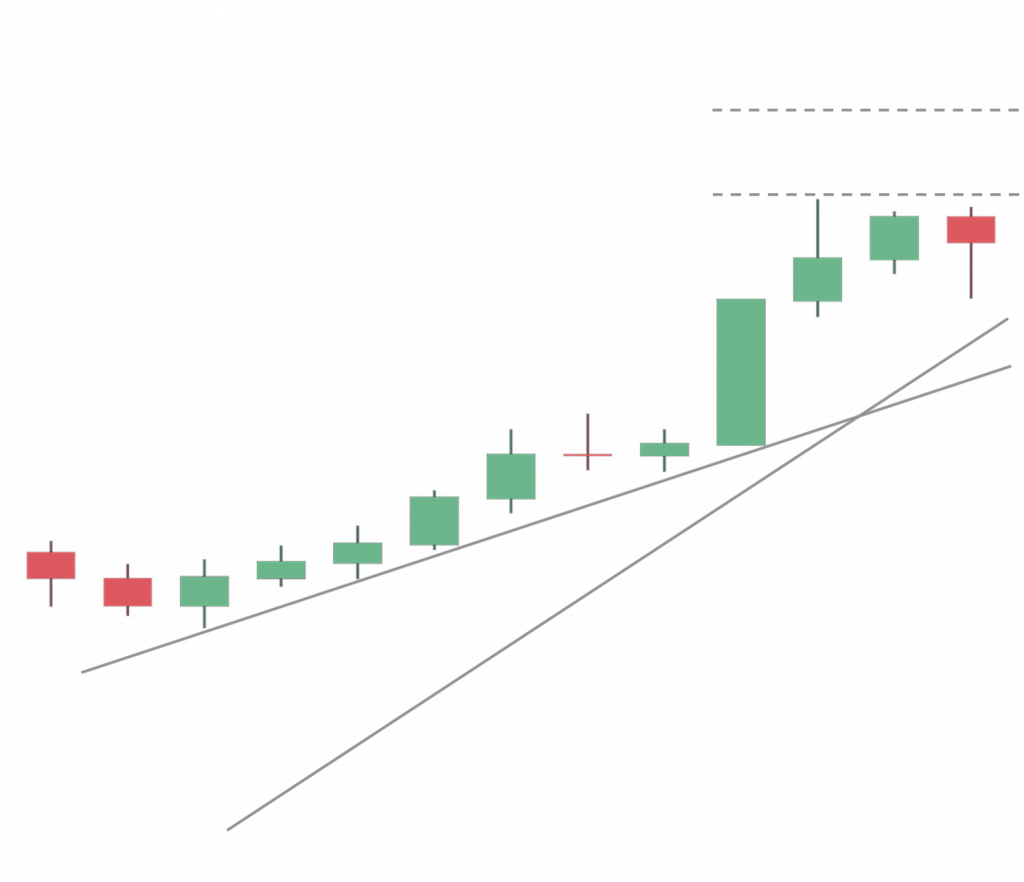

You analyze the graph to see trends, patterns, and formations in the price. There are numerous technical indicators for analyzing trends and formations. To analyze the price, traders use candlesticks because it contains more information than a regular line graph.

As you can see in the image, the graph consists of green and red rectangles, and they are called candlesticks. Each candlestick represents a time interval, usually one day. If the color is green, the price has risen during that period and at red, the price has fallen. The trend of the price depends entirely on the time interval you analyze.

Investing vs. Swing Trading vs. Day Trading vs. Scalping

There are four different ways to speculate on the price with various time settings; Investing, swing trading, day trading, and scalping. If you invest, you look at the big trend with a time horizon for several years. Swing trading is more short-term because you are speculating on the price for a few days or weeks.

Day trading, as the name suggests, is trading during the day. You watch the daily trend and close all orders at the end of the day. An even shorter time setting is scalping when you try to capture small movements in the price. Bitcoin traders then use leverage to trade on these small moves. With borrowed money the risk increases.

The shorter the time, the more difficult technical analysis becomes. If you’re just starting out with cryptocurrency trading, you should not trade on less time than 1-day candlesticks.

Traders can’t look into the future. Instead, they know the odds of the future, just as you can count on cards in Black Jack. You will make bad trades all the time, but if the odds are to your advantages, you can make money over time. However, if they are not, you might lose your entire capital.

Technical analysis works because several people look at the same technical indicators. Because several traders respond to the same price levels, it becomes a self-fulfilling prophecy.

3.1

Bitcoin Trader Tips: Successful Bitcoin Trading Strategies

Your trading strategy is the plan you have before you start trading Bitcoin and cryptocurrency. You need a clear plan before you initiate a trade. What will be the buying and selling prices for this trade?

Before you buy a cryptocurrency, you need to decide where you sell and within what timeframe. If you want to get started with trading, we recommend to scale in and out of your positions. Many traders prefer this instead of buying and selling the entire position because it reduces the risk.

The hit ratio for Bitcoin trading strategies will vary depending on the risk. We strongly recommend that you use a trading journal to record all orders. It’s important to evaluate how your trading strategies work.

Risk Management Is Underestimated

When you record your Bitcoin trading, you need to keep track of your risk/reward ratio. How big the risk is in relation to the reward per trade. This simple formula is essential because it helps you make rational trading decisions.

You should always use a stop loss to manage your risk. This means that the cryptocurrency is automatically sold at a predetermined price.

Let’s say you buy a cryptocurrency at $100, have a stop loss at $99 and a price target of $ 105. You can earn $5, that will be your reward. And you can lose $1, that will be your risk. This means that your risk/reward ratio will be 1:5 ($5 / $1 = 5). In other words, the potential profit is five times as high as the loss.

This is a risk/reward ratio that is usually recommended by traders. But let’s say that your trading strategy has a ratio of 1:10 (risk/reward). This means that the potential gain is 10 times as high as the risk.

In that case, you can lose 90% of your trades but still earn money. Since a winning trade generates as much money as 10 losing trades, the hit ratio can be low. However, it’s usually better to minimize losses than try to maximize profits in trading.

How to Make Money Trading Bitcoin

The best Bitcoin trading strategies depend on your preferences and risk level. Start slowly but surely and try different trading strategies. Don’t risk all your capital on single trades.

In trading, the guideline is to use 2-5% of your total capital per trade. This is an important rule to follow in order to make long-term money on trading Bitcoin and cryptocurrency. Choose a sustainable trading strategy!

The size of your losses determines if you are a good Bitcoin trader. Not the size of your winnings.

CHAPTER 4

The Best Bitcoin Trading Software & Tools

There are a variety of Bitcoin trading platforms with different tools. This is something you will notice in the crypto market. But what Bitcoin Trading Software is best? There is no straight answer to that question. Different Bitcoin traders value different tools.

Bitcoin Trading Software

Cryptocurrency brokers usually use their own trading software on its platform. There is also no lack of trading tools for technical analysis. At the same time, it’s easy to use many unnecessary tools that don’t really improve your Bitcoin day trading.

All traders need at least one technical analysis program. The most popular software for technical analysis is TradingView. It contains all the technical indicators and chart settings you need for Bitcoin trading.

TradingView also has a social network for traders where you can find many trading ideas from experienced Bitcoin och cryptocurrency experts. If you want to start trading, we strongly recommend TradingView. This is an excellent complement to your cryptocurrency broker platform.

Automated Bitcoin Trading

If you want to take the next step in trading, there is automated robot trading. This means that you create trading bots that apply your strategies to Bitcoin and cryptocurrencies. This is nothing for beginners, but with the knowledge, you can make a lot of money with automated Bitcoin trading.

The best software for bot trading in Bitcoin/cryptocurrency is Cryptotrader. You get access to several trading algorithms that are active in the market and many other features. However, don’t start with automated Bitcoin trading before you’re ready.

The crypto market, like trading software programs, is under continuous change and improvement. We recommend that you test multiple software and learn how to use their various tools. Take the opportunity with these software tools and improve your Bitcoin trading.

CHAPTER 5

Get Started: Trading Bitcoins for Beginners

It’s time to help you get started with Bitcoin Trading! In this section, we have many tips and advice on trading Bitcoin for profit. If you follow our advice, you have good chances of becoming a successful trader.

Focus on the Trend

There is always a certain trend that determines the direction in which the price moves. The trend along with volatility creates a trend channel. This becomes an area in which the price usually moves within.

A strong reaction in the market may cause the price to fall outside the trend channel. In this case, the trend direction can change. Otherwise, the cryptocurrency is overbought or oversold. In trading, the price can be described as a rubber band.

The price tends to move in waves and return to the middle of the trend channel. If the price increases much faster than the average, the rubber band will be tense, and then the price can be considered overbought.

This is why the moving average is one of the most popular technical indicators in trading.

Trading Bitcoin for Profit

- Learn technical analysis and use candlesticks – You need to learn technical analysis and use candlestick charts because it contains much more information than line diagrams.

- Use a trading journal – Write down all your orders, check your statistics and evaluate your trading strategies.

- Learn from your mistakes – All traders make mistakes, but it’s better to make mistakes in the beginning when your capital is less. Learn from your mistakes, you paid for them.

- Ignore untrustworthy sources – Many fake news and cryptocurrency scams try to fool other people through “pump and dump”.

- Have achievable goals with a reasonable time horizon – Many who start trading have too high expectations.

- Protect profits and limit losses – A tip is to start with lock-in winnings and always use a stop loss. You need to be consistent as a trader.

- Learn the correlation between cryptocurrencies – There are clear correlations between Bitcoin and different cryptocurrencies. This can give you an advantage when trading cryptocurrency.

- Don’t risk too much in the beginning – Start slowly but surely and improve your trading every day.

- Choose the best Bitcoin / Cryptocurrency Broker – You need to use all available advantages. Below you will find the best cryptocurrency broker.

CHAPTER 6

Conclusion: Best Bitcoin Trading Platform

We Test and Rate Brokers

When we rate cryptocurrency brokers, we look at many factors. This includes fees and costs, trading platform, leverage, customer service, demo account, deposit requirements, company background, customer satisfaction and more.

But most importantly, we are testing the trading platform. The overall user experience can be a decisive factor. There are many different brokers, and there are always new Bitcoin trading sites being introduced.

We update this guide and our comparison table all the time. All Bitcoin brokers have their pros and cons. We help you choose the right one!

The Key to Success → Never Give Up

Just like everything else, it will take time to get good at trading. Day trading Bitcoin is nothing that comes naturally. It takes time to learn how to read trends and patterns in price charts. Everyone makes mistakes at the beginning. The important thing is to learn from your mistakes.

You need to continually develop and adapt to the market as a Bitcoin trader. Cryptocurrencies constantly fluctuate in price, but experience and knowledge consist. Below you will find the best bitcoin trading platform.

| Invest in Bitcoin here

|

Risk Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Frequently Asked Questions

Is your question not answered here? Let us know!

There is no reason to make it harder than it is. Step 1: Start by comparing Trading Platforms on this page. Step 2: Choose the best broker and open account. Step 3: Make a deposit and start trading!

To become a successful Bitcoin trader, you need to constantly develop and adapt. When you start trading, there is a lot to learn. Everyone makes mistakes at the beginning. It’s important that you learn from your mistakes.

As with all currencies, the value depends on supply and demand. Bitcoin has value because there are high demand and low supply. Cryptocurrencies such as Bitcoin are available in limited amounts in the same way as precious metals such as Gold.

Also, normal fiat currencies such as Dollar and Euro have no limited supply. The central bank is creating more and more money which leads to inflation. Bitcoin protects your money from inflation.

A Contract for difference (CFD) is a type of derivative instrument that allows investors and traders to speculate on price changes in an underlying asset. For example, cryptocurrencies such as Bitcoin.

If you want to invest in Bitcoin and other cryptocurrencies, you can buy them at a Bitcoin Exchange. This is for long-term investors. But it also means you are responsible for security.

If you want to trade Bitcoin, we would recommend a broker instead of an exchange. By this, we mean a CFD broker offering trading products. Your money is also protected by the broker.

NOTE! If you choose an exchange instead of a broker, you need to buy a Bitcoin Wallet to protect your cryptocurrencies.

I must say this guide really helped me to start trading bitcoin. There is no other guide with this much useful information… Good job!

I will check this page from time to time.

Thanks for your comment Johnny!

That is a good idea since the comparison table is being updated with new brokers and the latest information.

/ CryptoRunner Team

My favorite broker for trading bitcoin is iq option. I would really recommend them to you all.

However I wonder if and when you will release a review page for iq option?

That would be of interested as I use the broker every day.

Thank you, btc trader

The review for IQ Option is in the pipeline. Our content editor will contact you when it’s published.

/ CryptoRunner Team